Please install a more recent version of your browser.

13 December 2022

5 minutes read

At our 'Fashion Expert Day: Alternative Growth Paths', Cyrielle Villepelet, partner at consultancy firm McKinsey & Co, presented the trend report The State of Fashion 2023 for the first time. This annual report provides an overview of all the major trends the fashion industry is expected to experience. During her presentation, Cyrielle summarised the key economic figures of the past year, and outlined some strategies to deal with the future challenges in the fashion industry.

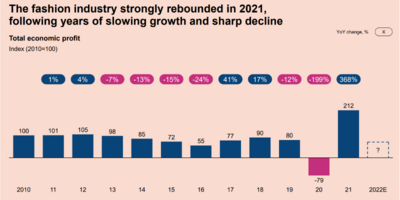

First, let's look at some statistics. The fashion industry strongly rebounded in 2021, following years of slowing growth and sharp decline.

Although economic profit increased significantly, the rebound in 2021 merely balanced out the losses from 2019 and 2020. The rise in economic gains in 2021 seemed extraordinarily positive, but much of the success in 2021 turned out to depend on 2020 being so negative. Economic results varied strongly by sector. As other sectors experienced a decline in value, luxury and sportswear managed to create incremental value on top of capturing pent-up demand after the crisis. The luxury segment benefited from rich individuals who were not as financially affected by the pandemic as others. Also middle-income consumers spend their money on luxury. They saved money during COVID-19 and wanted to indulge themselves after the pandemic. The incremental value created by sportswear in 2021 was due to consumers dressing more casually during but also after the pandemic.

You can find more economic predictions at The Business of Fashion.

“The accumulation of these risks points towards a highly challenging 2023. Companies will need to build in resilience and new strategies to capture the pockets of opportunities.”

Our global economy is very unstable. We are facing the highest inflation in years, rising geopolitical tensions such as the war in Ukraine, the climate crisis and declining consumer confidence. Fashion brands will have to plan their activities carefully to overcome the many uncertainties and recession risks that 2023 will bring us. This means they have to:

As a fashion brand, the question where to invest globally has never been easy. Political tensions make this question increasingly difficult as it is not just the financial picture that matters. Brands should therefore re-evaluate their regional growth opportunities and sharpen their strategies so that they are better adapted to the regions in which they operate. According to McKinsey, it is best to invest in regions such as the US and the Middle East. These are the regions that continue to drive economic growth in times of economic uncertainty.

The potential economic turbulence in 2023 will cause consumers to adjust their purchasing behaviour. Depending on their disposable income, they will postpone purchases, limit purchases or wait for bargains. This may increase demand for second-hand items, rentals or discounts. Therefore, brands should adjust their business model accordingly to retain their customers. This can be done, for instance, by introducing new channels or new pricing techniques.

The pandemic has led to blurring boundaries between formal and leisure wear. People are dressing more casually. This trend, according to McKinsey, will continue in the future. On the other hand, there is a clear demand for statement pieces for events. This trend is also present among younger generations. Luxury brands can take advantage of this. Besides this, we clearly see a shift towards renting rather than buying clothes. According to McKinsey, brands should dare to push their boundaries and offer these alternatives.

More and more consumers around the world are showing growing interest in gender fluid fashion. This shift is visible not only on high fashion runways but also in traditional shopping behaviour. The challenge for brands is to embed a gender-neutral dimension or vision in the entire business in the future.

With rising marketing and e-commerce costs, fashion brands should re-evaluate the viability of their D2C (direct to consumer) model. To grow, diversification in sales channels is important. They can, for example, also bet on wholesale or third-party marketplaces.

Due to privacy regulations, personalisation is becoming increasingly difficult in terms of marketing and communications. Brands should be more creative in their messages and content, or use new channels such as metaverse, for example, to collect valuable data. This data allows them to respond to customers' specific needs, strengthening customer relationships. On top of data collection being more difficult, the many cultural differences also need to be addressed. Today, as an international brand, you need to build a customised approach with an adapted tone of voice, look and feel, PR approach, content and so on to address local consumers appropriately.

Sustainability is becoming the norm. Consumers are increasingly scrutinising the green efforts of labels. Greenwashing is being condemned more severely than ever. Therefore, the way in which brands communicate their sustainability will become increasingly important. If brands want to avoid greenwashing, they need to make meaningful and sustainable changes while complying with new regulations around sustainability.

The COVID-19 pandemic exposed many supply chain disruptions. To be prepared for such events in the future, textile manufacturers should create new supply chains. According to McKinsey, these should be based on three elements:

To achieve this, supply chains should be driven by digitalisation leading to significant cost advantages. On top of that, it is expected that digitalisation in the supply chain will be the most important driver for suppliers’ growth in the future.

Finally, fashion professionals need to form a new vision. They will have to think about what their business needs in the future. In doing so, they will need to focus on humanity, sustainability and technology in their operations. An enhanced focus on top talent is needed while the report projected a growing skills shortage for 2023. Fashion executives therefore need to attract and retain top talent for their teams and C-roles to execute sustainability and digital acceleration. Only in this way, fashion brands will be able to properly implement new strategies and deal with the challenges of the future.

In summary, the fashion industry will face many challenges in 2023. Brands will have to re-evaluate their current strategies and adapt where necessary. The priorities for fashion companies in 2023 from McKinsey's & Bof trend report can provide a starting point for responding to current challenges and shifts in the industry. Download the full report to be completely in tune with the themes in the fashion sector in 2023.

Cookies saved